新書推薦:

《

黄河大系·戏曲卷

》

售價:NT$

4121.0

《

大模型与超级平台

》

售價:NT$

352.0

《

数学通俗演义

》

售價:NT$

281.0

《

中国古代小说学史

》

售價:NT$

857.0

《

中国海域史·南海卷

》

售價:NT$

500.0

《

粤港澳大湾区:图片故事

》

售價:NT$

1877.0

《

操盘华尔街:“百年美股第一人”的的投资智慧

》

售價:NT$

347.0

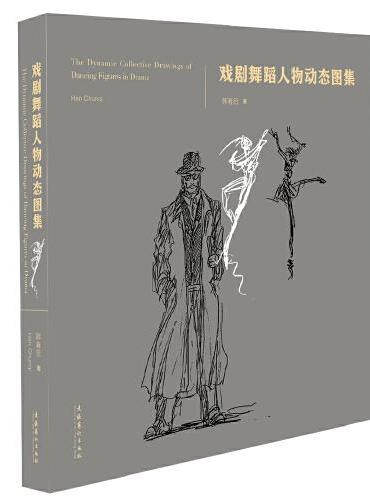

《

戏剧舞蹈人物动态图集(绝美的服装设计和极致的身体动态美感展现)

》

售價:NT$

1632.0

|

| 編輯推薦: |

|

本书有三个特点: ☉第一个特点是关注发展中国家所面临的问题。这种关注从三个方面影响本书内容的呈现: 一是在理论框架上,对“不可能三角”中的每一种政策选择都给予同等认真细致的分析; 二是在数据和案例的呈现上,本书更倾向于用发展中国家,尤其是中国的数据来检验和应用国际金融理论; 三是专设章节,从理论和实践方面回顾了国际资本市场带给发展中国家的机遇与风险。 ☉第二个特点是遵从国际金融研究规律,将经济事实与模型相结合,引入最新研究成果。本书的理论框架并未偏离经典模型而独辟蹊径,经典理论对全球资本流动因果的洞悉是深刻而隽永的,但在应用上则需要根据国情对假设做出限制,这也是本书的贡献所在。 ☉第三个特点是书中加入大量数据分析案例。这些案例将引导读者从数据中运用统计学、计量经济学工具提炼国际金融典型事实,理解国际金融理论。 同时本书为数字化教材,配有丰富数字资源。

|

| 內容簡介: |

在《国际金融》中,三位作者结合中国与其他发展中国家的实际经验,系统介绍了国际金融领域的经典理论、模型、案例,并讨论它们在中国的具体应用。内容安排方面,《国际金融:中国情景(英文版)》首先介绍了国际金融最重要的变量——汇率;然后介绍一个国家的国际收支平衡表,金融的全球化成本收益分析,开放经济中一个国家的财政、货币政策组合;最后介绍一个国家的汇率制度选择,以及各个国家面对全球经济冲击时协调货币政策的可能性。在介绍完经典模型后,《国际金融:中国情景(英文版)》专门讨论如何将经典模型用于分析中国的经济问题,特别是中国逐步开放的动态过程。同时,《国际金融:中国情景(英文版)》涵盖大量数据分析案例,引导读者从数据中运用统计学、计量经济学工具提炼国际金融典型事实,理解国际金融理论。

《国际金融:中国情景(英文版)》可作为普通高等院校国际金融课程教材、党校及干部培训教材,也可作为希望了解国际金融学知识读者的参考书。

|

| 關於作者: |

王潇

----------------------------

王潇,中国科学技术大学管理学院教授、国际金融研究院院长助理,北京大学经济学硕士,威斯康星大学经济学博士,曾任美国北达科他大学副教授。主要研究方向为国际金融和国际贸易。

史蛟

----------------------------

史蛟,北京大学汇丰商学院助教授,威斯康辛大学麦迪逊分校经济学博士。主要研究方向为国际宏观经济学、外商直接投资、宏观经济学。

王健

----------------------------

王健,香港中文大学(深圳)经管学院教授,清华五道口金融学院金融硕士导师,中国金融四十人青年论坛会员,美国威斯康星大学经济学博士。主要研究方向为国际金融市场和货币政策。

|

| 目錄:

|

Chapter 1 Introduction and Background / / 1

1. 1 Features of the Book / / 3

1. 1. 1 Subject Matters and Tools of International Finance / / 4

1. 1. 2 Research Method and Logic of the Book / / 7

1. 1. 3 Applicability of the Book / / 8

1. 2 Overview of Contents / / 10

1. 2. 1 Exchange Rate / / 10

1. 2. 2 Balance of Payments and Financial Globalization / / 11

1. 2. 3 International Financial Market, Institutions and Institutional Reform / / 11

1. 3 Background: Globalization and China Opening-up / / 12

1. 3. 1 Recent History of Globalization / / 12

1. 3. 2 China s Opening-up / / 16

Chapter 2 Basic Theories of Exchange Rate / / 21

2. 1 Exchange Rate and Foreign Exchange Market / / 24

2. 1. 1 Definition of Exchange Rate / / 24

2. 1. 2 Exchange Rate Regime and Exchange Rate Determination Mechanism / / 27

2. 1. 3 Foreign Exchange Market and Foreign Exchange Derivatives / / 33

2. 2 Exchange Rate Arbitrage and Interest Rate Parity Formula / / 44

2. 2. 1 Exchange Rate Arbitrage / / 44

2. 2. 2 Covered Interest Rate Parity Formula / / 45

2. 2. 3 Uncovered Interest Rate Parity Formula / / 47

2. 2. 4 Risk and Liquidity / / 50

Chapter 3 Long-term and Short-term Pricing of Exchange Rate / / 59

3. 1 Long-term Pricing of Exchange Rate / / 61

3. 1. 1 Law of One Price and Purchasing Power Parity / / 61

3. 1. 2 Absolute Purchasing Power Parity and Relative Purchasing Power Parity / / 63

3. 1. 3 Long-term Pricing of Exchange Rate: The Balassa-Samuelson Model / / 71

3. 1. 4 Long-term Pricing of Exchange Rate: Monetary Price / / 75

3. 2 Short-term Pricing of Exchange Rate / / 77

3. 2. 1 Short-term Pricing of Exchange Rate: Asset Approach / / 78

3. 2. 2 Long-term and Short-term Pricing Models of Exchange Rate: Money and Monetary Path / / 80

3. 2. 3 Fixed Interest Rate and the Trilemma / / 83

3. 2. 4 Exchange Rate Prediction / / 86

3. 3 Foreign Exchange Control / / 89

3. 3. 1 Foreign Exchange Control and Foreign Exchange Reserve Management / / 89

3. 3. 2 History and Reform of the Renminbi Exchange Rate / / 92

Chapter 4 Balance of Payments and Financial Globalization / / 97

4. 1 International Transactions and Balance of Payments / / 99

4. 1. 1 Macroeconomic Transactions and Macro Accounts / / 99

4. 1. 2 The Balance of Payments Accounts / / 103

4. 1. 3 External Wealth of a Nation / / 112

4. 2 Cost-benefit Analysis of Financial Globalization / / 121

4. 2. 1 Small Open Economy Model / / 121

4. 2. 2 Consumption Smoothing / / 123

4. 2. 3 Improvement of Investment Efficiency / / 127

4. 2. 4 Risk Diversification / / 129

4. 3 Efficiency of International Financial Market / / 130

Chapter 5 Open Economy Macroeconomic Model and Policy Analysis / / 137

5. 1 Keynesian Model in Open Economy / / 139

5. 1. 1 Aggregate Demand / / 139

5. 1. 2 Goods Market and Foreign Exchange Market Equilibrium / / 143

5. 1. 3 Money Market Equilibrium / / 144

5. 1. 4 Home Country Equilibrium / / 145

5. 2 Policy Analysis with the Keynesian Model / / 146

5. 2. 1 Temporary Monetary and Fiscal Policies / / 146

5. 2. 2 Permanent Monetary and Fiscal Policies / / 158

5. 2. 3 Macroscopic Policy and Current Account / / 161

5. 2. 4 Liquidity Trap / / 165

Chapter 6 Exchange Rate Regimes / / 171

6. 1 Exchange Rate Regime Classification / / 173

6. 2 Theory of Fixed Exchange Rate Regimes / / 179

6. 2. 1 The Central Bank Balance Sheet and Money Supply / / 180

6. 2. 2 Economic Policy under a Fixed Exchange Rate Regime / / 186

6. 3 Considerations for Choosing an Exchange Rate Regime / / 197

6. 3. 1 Similarity of Shocks between the Pegging Country and the Anchor Country / / 197

6. 3. 2 Economic Integration / / 199

6. 3. 3 Effects of Exchange Rate Regime on Trade / / 199

6. 3. 4 Exchange Rate Regime and Monetary Discipline / / 203

6. 3. 5 Exchange Rate Regime and Wealth Shocks / / 204

6. 3. 6 Discussion: The Feasibility of Fixed Exchange Rate Regime / / 206

Chapter 7 Capital Control and Capital Flow Management / / 211

7. 1 International Capital Flow and Classification / / 214

7. 2 International Capital Control Policy / / 217

7. 2. 1 Capital Control / / 217

7. 2. 2 Capital Control and Macroprudential Management / / 221

7. 3 The Macroeconomy and Policy Effects under Capital Control / / 223

7. 3. 1 Basic Model Assumptions / / 224

7. 3. 2 Monetary Policy / / 225

7. 3. 3 Fiscal Policy / / 228

7. 3. 4 Exchange Rate Policy: Change of the Target Exchange Rate / / 230

7. 3. 5 Discussion: Pros and Cons of Capital Controls / / 232

7. 4 Foreign Direct Investment / / 233

7.4.1 FDI`s Influence on Productivity and Economic Development / / 233

7. 4. 2 Determinants of FDI Flow / / 236

Chapter 8 Developing Countries / / 241

8. 1 Growth and Divergence in the World Economy / / 243

8. 1. 1 Income Disparity and Happiness / / 243

8. 1. 2 Prediction of the Classical Growth Theory and Partial Convergence / / 245

8. 2 Capital Flows to Developing Countries, Risks, and Crises / / 249

8. 2. 1 Financial Flows to Developing Countries / / 249

8. 2. 2 Defaults and Capital Flow Reversals / / 255

8. 2. 3 Currency Mismatch and the “Original Sin” / / 257

8. 3 Emerging Market Balance-of-Payment Crises / / 259

8. 3. 1 Latin American Debt Crisis in the 1980s / / 259

8. 3. 2 Asian Financial Crisis, 1997 -1998 / / 261

8. 4 Reforming the International Safety Nets / / 269

8. 4. 1 The Revival of Capital Controls / / 269

8. 4. 2 Foreign Exchange Reserves / / 271

8. 4. 3 Regional Safety Nets and Central Bank Swaps / / 272

8. 4. 4 The Role of the IMF / / 273

|

|